- #Reminder letter to customer for overdue payment how to

- #Reminder letter to customer for overdue payment professional

Re-asking for a payment that you’ve not already asked for doesn’t exactly scream professionalism. Make sure everything is correct on your end before you take your query to a customer. It might seem obvious, but you’ll look like such a dunce if you never actually sent the invoice, or if it’s stuck in your outbox. Check that the client actually received the invoice The following six must-haves and must-dos for your payment reminder email are essential to secure your payment in a timely manner, whilst making sure you maintain a positive, withstanding brand-customer relationship.

#Reminder letter to customer for overdue payment professional

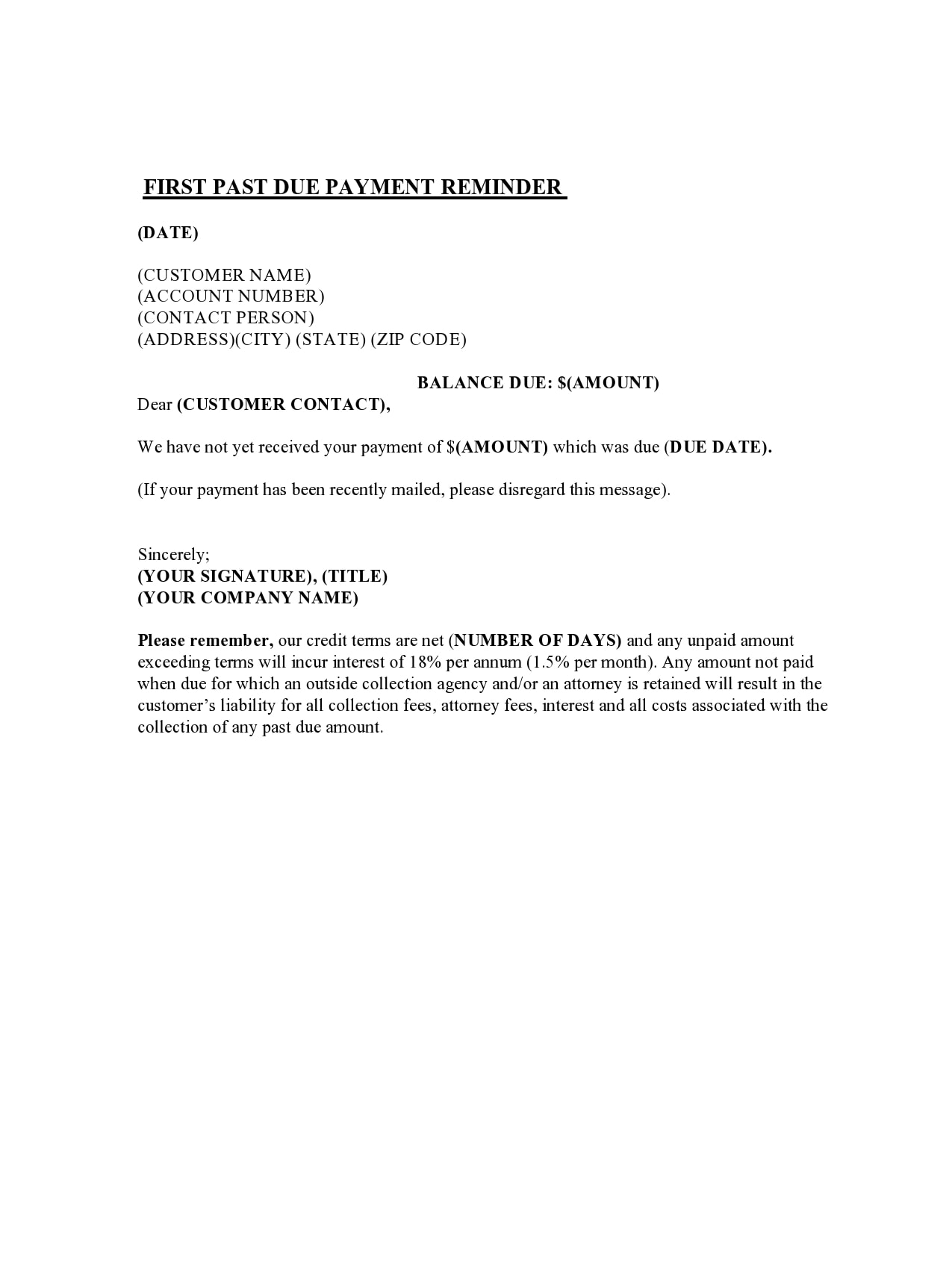

It's essential to be consistent with your reminders, follow up on time, and keep the communication professional and courteous. Keep in mind that the timing of these reminders may depend on your business's payment policies and the relationship you have with the client. You can also consider involving a lawyer or debt collection agency at this point. This email should be more formal and assertive, clearly stating the consequences of non-payment, such as legal action or debt collection. Final Notice: If you still haven't received payment after the second reminder, it's time to send a final notice.You can also consider calling the client or sending a physical letter as a follow-up to the second reminder. This email should remind the client of the payment due date, mention any late fees or penalties, and offer help or assistance if there are any issues. Second Reminder: If you haven't received payment after the first reminder, it's time to send a slightly more assertive email.You can use this email to check-in with the client and see if there are any issues with the payment. The tone of this email should be friendly and assume the best intentions from the client. First Reminder: Send a gentle reminder a few days after the payment due date.

Here are some general guidelines for when to send a payment reminder email: You don't want to come off as pushy or aggressive, but you also can't afford to let the payment slip through the cracks. Sending a reminder email for payment is a delicate matter. When to send a reminder email for payment On the day of the payment, we remind our client that their payment is due.Ī day after the payment was due, we remind our sales rep via the Tasks feature that they need to follow up on that payment.

The same happens again three days late - now we know our client definitely knows that they need to pay. At the same time, the relevant rep is reminded that this client needs to pay. When we’re waiting for our payment, we send a reminder to the client seven days before it’s due. From there, our workflow splits into three branches: Payment received, Waiting for payment, and Payment missed. Our workflow starts when a sales rep has completed a deal, and they move that deal into the Waiting for payment stage on our pipeline. It only took my tiny copywriter mind half an hour to whip up. Automatically remind your customers to pay their invoice remind your sales reps to ask, there’s no complicated coding required.Īll you need is a NetHunt CRM subscription, a good knowledge of your business workflows, and a customer that needs reminding to pay their outstanding invoice! It helps your sales, marketing, and support teams to automate those nitty-gritty jobs. Workflows by NetHunt CRM is an automatic workflow builder.

#Reminder letter to customer for overdue payment how to

This is how to remind a client to pay you after their invoice deadline has passed.Īutomate client-payment reminders with NetHunt CRM

0 kommentar(er)

0 kommentar(er)